from Cinegraphic.net:

The Rentier Illusion

story © Michael Betancourt, March 28, 2011 all rights reserved.

URL: https://www.cinegraphic.net/article.php?story=20110327092725535

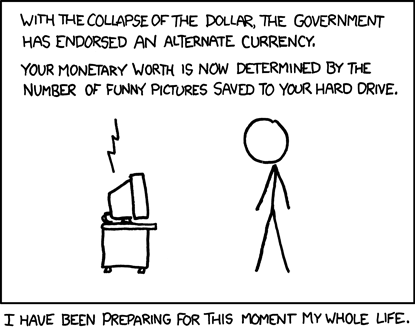

Rentier currency—money that comes into existence not as a representation of past productive value, but by as a debt (loaned or borrowed)—enjoys an illusory foundation precisely in that within capitalist economies the demand for escalating value masks the rentier paradox: that the debt posed by the rentier claim inherently always corresponds to a larger value than there are values for (re)payment.

When a rentier currency is in use, its apparent foundation as either asset-backed or fiat currency is irrelevant because of how the rentier demand comes to dominate the creation of value. Within capitalist production, the creation of excess value masks the inevitability of collapse for a period precisely because it creates the appearance of additional value production in excess to what rentier demands are being made in a cyclical ascending spiral of value creation and rentier demand (this formation is readily apparent as the Ponzi scheme.)

When the productive action is connected to asset creation (physical or immaterial) the resulting period of value creation passes through periods of productive expansion, followed by accelerating financialization as the rentier demands accumulate followed by a collapse: a form familiar as the various bubbles that have accompanied capitalist production over the past two centuries. As rentier demands come to dominate, all forms of previously existing value are necessarily consumed in the consumptive demand posed by rentier currency, necessitating the expansion of value production into new domains where financial innovation required by rentier demand mirrors the expansion of capitalist valorization in a self-reinforcing, reciprocal process. This development is required by both the rentier currency and by the capitalist need for greater accumulation; in this regard, the rentier currency is both an exquisite expression of fundamental capitalist ideology and, simultaneously, a primary factor forcing the collapse of that expansive procedure: the bursting of bubbles.

Copyright © Michael Betancourt March 28, 2011 all rights reserved.

All images, copyrights, and trademarks are owned by their respective owners: any presence here is for purposes of commentary only.